Characteristics of China’s domestic commercial vehicle market—June 2024 (1.0)

time2024/07/30

- The commercial vehicle export market has shown explosive growth in recent years, while the domestic commercial vehicle market will…

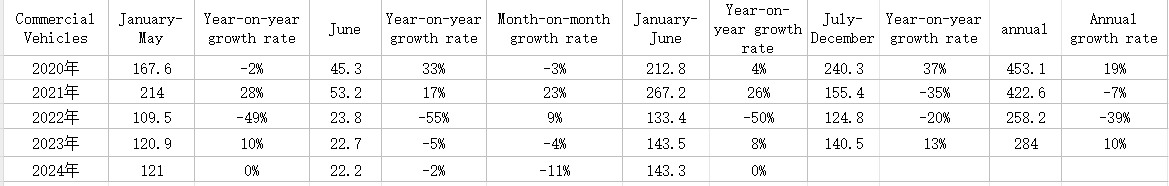

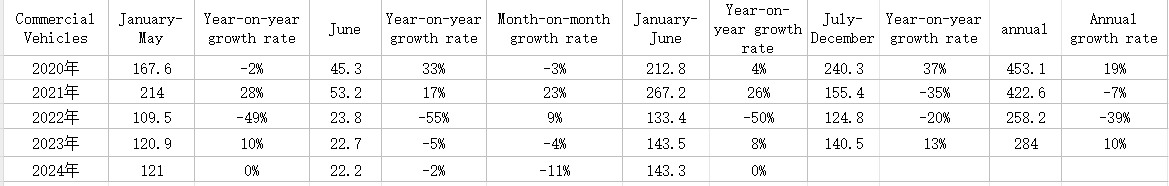

According to insurance data from the National Financial Bureau, the commercial vehicle export market has exploded in recent years, while the domestic commercial vehicle market has experienced strong growth before 2021 and has recently entered a stage of slow growth. Due to the complex interference of the Spring Festival factors, domestic sales of commercial vehicles in January and February this year were temporarily sluggish, and then strengthened significantly from March to June. From January to June this year, domestic sales of commercial vehicles reached 1.43 million units, a year-on-year decrease of 0.1%; in June, domestic sales of commercial vehicles reached 220,000 units, a year-on-year decrease of 2% and a month-on-month decrease of 11% from May. From January to June 2024, the penetration rate of new energy commercial vehicles in commercial vehicles reached 16%, of which the penetration rate of new energy reached 21% in June, an increase of 10 percentage points from 11% in June last year. The performance of markets such as new energy light buses is relatively strong.

1. Analysis of compulsory traffic insurance data in the national commercial vehicle market

In recent years, the domestic commercial vehicle market has shown a rapid decline in demand. From the ultra-high sales in 2020 to the policy entry period in 2021. It is in a trough period from 2022 to 2023. From January to June this year, domestic sales of commercial vehicles reached 1.43 million units, a year-on-year decrease of 0.1%; in June, domestic sales of commercial vehicles reached 220,000 units, a year-on-year decrease of 2% and a month-on-month decrease of 11% from May. From January to June this year, the year-on-year growth was due to the market recovery.

This year, the commercial vehicle market showed an overall stable trend, and the monthly trend was similar to that of 2021, with relatively large fluctuations from January to June. Due to the dislocation of the Spring Festival, commercial vehicle sales in June this year were 220,000 units, a month-on-month decrease for three consecutive months, and the demand recovery after May this year was not obvious.

The comprehensive inventory increase from January to December 2023 should reach 420,000 units, which is at a historical high. The remaining inventory of manufacturer sales-insurance-export volume in the first half of 2024 is 244,000 units, which is relatively large. The inventory in June 2024 increased significantly by 41,200 units, and the inventory is sufficient.

2. Analysis of sales volume of new energy commercial vehicles in the country

In January-June 2024, sales volume of new energy commercial vehicles reached 228,000 units, a year-on-year increase of 119%; in June 2024, it reached 46,000 units, a year-on-year increase of 88%, which was relatively strong, showing a good market growth after the continuous subsidy withdrawal.

In 2023, new energy commercial vehicles as a whole showed a low level in January-April due to the impact of subsidy withdrawal, and strong growth in May-December. In January-February 2024, the monthly trend returned to normal, and the start of March-June after the holiday also showed a good growth situation with a rapid recovery.

3. Penetration rate of new energy commercial vehicles

From January to June 2024, the penetration rate of new energy commercial vehicles in commercial vehicles reached 16%, which was a good improvement compared with last year.

In June, the penetration rate of new energy reached 21%, an increase of 10 percentage points compared with 11% in June last year, which was relatively strong.

From 2019 to 2021, the penetration rate of new energy commercial vehicles was around 3%, reaching 9% in 2022 and 11% in 2023. From January to June this year, it reached a good level of 16%, reflecting the strong growth of new energy commercial vehicles.

In 2024, the penetration rate of new energy trucks was 12%, and that of buses was 56%, both of which were slightly higher than the same period. Among them, the penetration rate of electric vehicles for light trucks and light buses has increased significantly.